dog insurance companies compared in plain steps

You want fewer surprises and a fast path to reimbursement. This guide trims noise and focuses on the pieces that actually change outcomes: coverage scope, the three pricing levers, and claim speed.

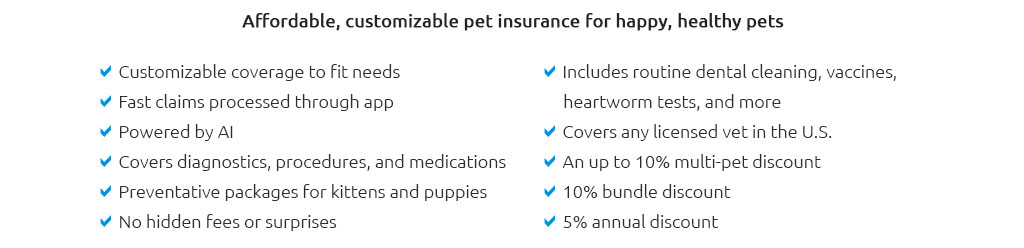

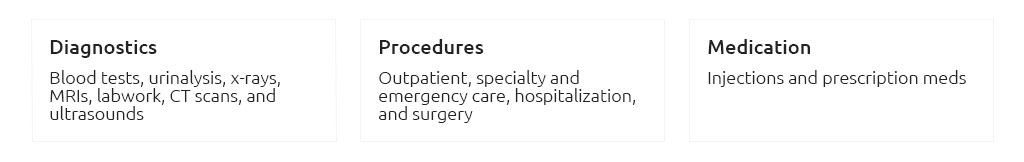

What dog insurance companies actually cover

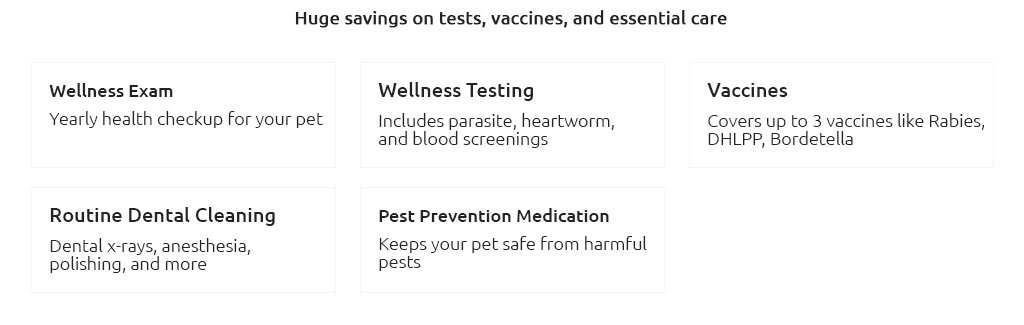

Most policies revolve around accidents and illnesses. Some add wellness, which is predictable care, not insurance in the strict sense.

- Accidents: broken bones, foreign-body ingestion, lacerations.

- Illnesses: ear infections, allergies, GI issues, cancer.

- Optional: exam fees, dental trauma vs dental disease, rehab, prescription food.

Temper expectations: pre-existing conditions are typically excluded, and premiums can rise yearly as your dog ages and vet costs change. That's normal, not a mistake.

Step-by-step to pick a plan

- Define your goal: protect against big bills, not every routine visit.

- Get two quotes per company: one with a higher deductible, one lower. Note the price difference.

- Choose a deductible you can comfortably pay once per year without stress.

- Set an annual limit: $10k covers many emergencies; higher for breeds prone to costly issues.

- Select reimbursement rate: 70 - 80% often balances cost with value.

- Check waiting periods: accidents vs illnesses vs cruciate/hip separate waits.

- Scan exclusions: hereditary, bilateral conditions, dental disease, alternative therapies.

- Claims flow: app upload, direct deposit, typical decision time.

- Vet choice: most allow any licensed vet; confirm if referrals need pre-approval.

For simplicity, you'll mostly juggle three numbers and one rule: if the monthly price jump is larger than the benefit you're likely to use, take the cheaper configuration.

The three numbers that matter

- Deductible: pay this first each policy year; higher deductible lowers premium.

- Reimbursement %: what the insurer pays after deductible; 80% means you pay 20% coinsurance.

- Annual limit: the cap they'll pay in a year; higher cap protects against rare but expensive events.

A quick sample comparison workflow

At 11:40 p.m., after a chocolate scare, I snapped the itemized ER invoice in the parking lot, uploaded it in the app, and saw payment hit my account two days later. That's the experience you're aiming for - quiet and straightforward.

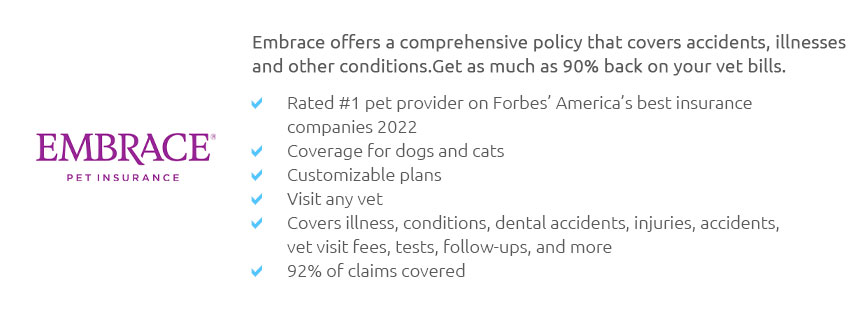

- Shortlist 2 - 3 companies with clean exclusions and fast claim tools.

- Price two setups at each: (a) $500 deductible, 80% reimbursement, $10k limit; (b) $250 deductible, 80%, $10k.

- Calculate your out-of-pocket on a $2,000 claim for each setup; pick the one that hurts less long-term.

- Skim policy for cruciate/hip waits and bilateral clauses; remove any that feel restrictive.

Red flags and fine print

- Bilateral clauses: tear one knee now, other knee later may be excluded.

- Pre-existing look-back: symptoms noted in records can count, not just diagnoses.

- Exam fees: sometimes excluded unless you add a rider.

- Dental: trauma is usually covered; periodontal disease often not.

- Per-incident caps: can limit payout even if your annual limit is high.

- Claim deadlines: late submissions can be denied.

How premiums evolve

Expect increases with age and regional costs. Switching later can reset pre-existing status, so factor longevity into your choice. Discounts (multi-pet, pay annually) are nice but not decisive.

Simplest rule set (result over fuss)

- Pick the highest deductible you can comfortably pay once per year.

- Set 80% reimbursement unless the price jump is steep; drop to 70% if needed.

- Use a $10k+ annual limit unless breed risk is low and budget is tight.

- Only add riders that protect against big costs; skip wellness unless it nets out.

Light budgeting example

$6,000 surgery, $500 deductible, 80% reimbursement: you pay $500 + 20% of $5,500 = $500 + $1,100 = $1,600. Result: you avoid a $6,000 shock and keep cash flow predictable.

Filing claims without friction

- Ask for an itemized invoice and medical notes; upload both.

- Enable direct deposit and push notifications.

- Submit within 24 - 48 hours while details are fresh.

- For big procedures, request pre-approval when possible.

Most straightforward claims resolve in about a week; complicated histories take longer. Keep expectations steady and documentation tidy.

Quick glossary

- Deductible: what you pay first each policy year or per condition.

- Reimbursement rate: percentage paid after deductible.

- Waiting period: time before certain claims qualify.

- Pre-existing: signs or symptoms before start date or during look-back.

Checklist you can copy

- Goal: protect against large, unpredictable bills.

- Pick deductible you can cover instantly.

- 80% reimbursement if cost-effective.

- $10k+ annual limit.

- Confirm: exam fees, dental, bilateral rules.

- Check waits for accidents/illness/orthopedic.

- Test claim app and payout speed.

- Reassess annually; avoid switching lightly.

Keep it simple, document well, and let the policy do the quiet work during the rare, expensive moments.